Harwood company uses a job-order costing system – Harwood Company’s adoption of a job order costing system presents a compelling case study, showcasing the effective management of costs in a dynamic business environment. This in-depth exploration unravels the intricacies of their costing system, shedding light on its purpose, implementation, and the meticulous accumulation of costs.

The job order costing system serves as the backbone of Harwood Company’s cost accounting practices, providing granular visibility into the costs associated with each unique production job. This system empowers decision-makers with timely and accurate information, enabling them to optimize resource allocation, enhance efficiency, and drive profitability.

Job Order Costing System

A job order costing system is a method of cost accounting used to track costs associated with specific jobs or orders. It is commonly employed in industries where production is customized or unique for each customer, such as construction, engineering, and printing.

The purpose of a job order costing system is to provide detailed information about the costs incurred in completing each job. This information can be used to calculate the profitability of individual jobs, set prices, and improve efficiency.

Benefits of Using a Job Order Costing System

- Accurate job costing: Provides precise information about the costs associated with each job, ensuring accurate pricing and profitability analysis.

- Improved cost control: Allows for the identification of cost inefficiencies and areas for improvement, leading to better cost management.

- Enhanced decision-making: Facilitates informed decision-making by providing detailed cost information for specific jobs.

- Increased customer satisfaction: Enables the company to accurately bill customers for the actual costs incurred in completing their jobs.

Harwood Company’s Job Order Costing System: Harwood Company Uses A Job-order Costing System

Harwood Company utilizes a job order costing system to track the costs associated with its custom-made furniture orders. The system is implemented as follows:

- Each customer order is assigned a unique job number.

- Costs are accumulated for each job based on direct materials, direct labor, and overhead.

- Job cost sheets are used to track the costs incurred for each job.

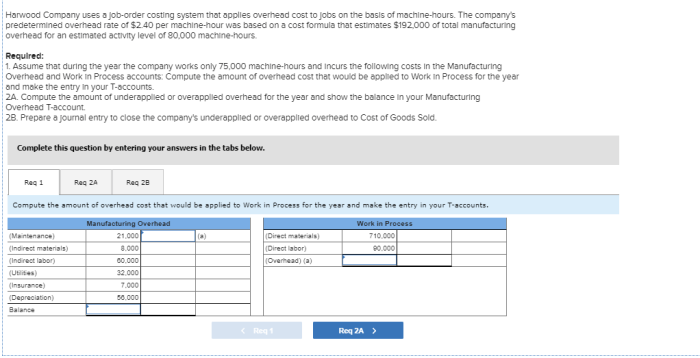

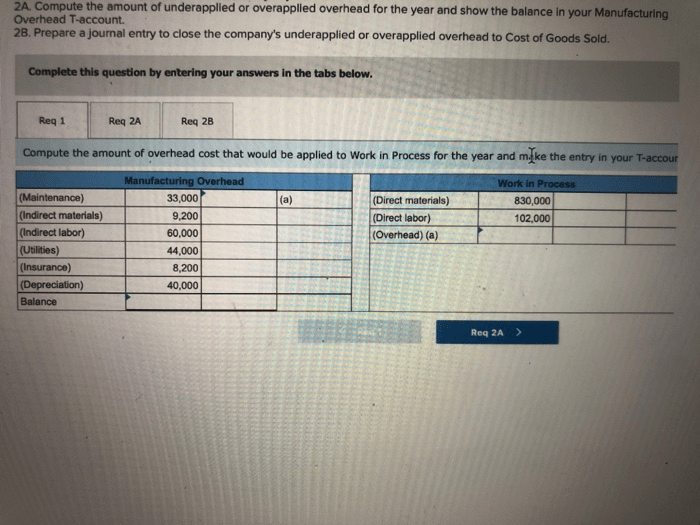

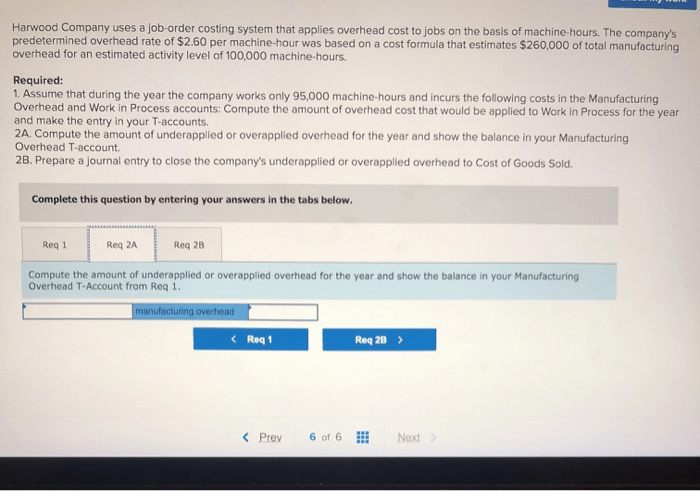

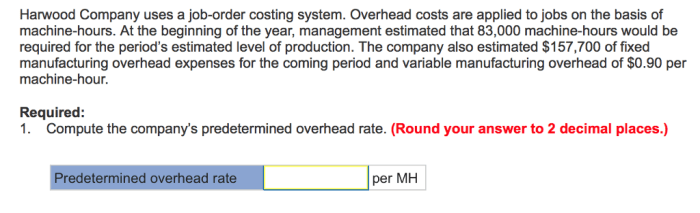

- Overhead costs are applied to jobs using a predetermined overhead rate.

Cost Accumulation

In Harwood Company’s job order costing system, costs are accumulated for each job based on the following categories:

Direct Materials

Direct materials are the raw materials that are directly used in the production of a job. They are assigned to specific jobs based on the actual quantity of materials used.

Direct Labor

Direct labor refers to the wages paid to employees who work directly on a job. It is assigned to specific jobs based on the actual hours worked.

Overhead Costs, Harwood company uses a job-order costing system

Overhead costs are indirect costs that cannot be directly assigned to a specific job. They are applied to jobs using a predetermined overhead rate.

Job Cost Sheets

Harwood Company uses job cost sheets to track the costs incurred for each job. The job cost sheet includes the following information:

- Job number

- Customer name

- Date the job was started

- Date the job was completed

- Direct materials costs

- Direct labor costs

- Overhead costs

- Total job cost

Overhead Application

Harwood Company applies overhead costs to jobs using a predetermined overhead rate. The overhead rate is calculated by dividing the total estimated overhead costs for a period by the total estimated direct labor hours for the same period.

The overhead rate is then used to apply overhead costs to jobs based on the actual direct labor hours incurred for each job.

Cost Reconciliation

Harwood Company performs cost reconciliation to ensure the accuracy of its job order costing system. Cost reconciliation involves comparing the total costs accumulated for each job to the total revenue generated from the sale of that job.

Any significant differences between the accumulated costs and the revenue are investigated to identify and correct any errors in the costing system.

Question Bank

What are the primary benefits of a job order costing system?

Job order costing systems offer several advantages, including improved cost control, accurate job profitability assessment, enhanced decision-making, and streamlined operations.

How does Harwood Company accumulate costs in its job order costing system?

Harwood Company employs a comprehensive approach to cost accumulation, capturing direct material costs, direct labor costs, and manufacturing overhead costs. These costs are meticulously assigned to specific jobs, providing a clear picture of the total cost of each production run.

What methods can be used for overhead application in a job order costing system?

There are several methods available for overhead application, including the actual overhead rate method, the normal overhead rate method, and the predetermined overhead rate method. Harwood Company selects the most appropriate method based on the nature of its operations and cost behavior.